What if I told you about a revolutionary and innovative company that seeks to disrupt the beverage industry inside and out? This company is not your typical corner lemonade stand but a publicly traded company with a valuation of over $200 million and clients that consist of Fortune 500 companies and prominent athletes. Its stock has rocketed over 14,000% year to date. Its CEO strives to provide transparency and delivers by communicating with shareholders and clients regularly through social media. Don’t you want to own a piece of this once in a lifetime opportunity of a company?

I’m talking about Labor Smart’s subsidiary Takeover Industries.

While Labor Smart is a multifaceted and diverse holdings company with many different ventures and purposes, what’s most intriguing about them is their expansion into the beverage industry featuring NXT LVL Hydrogen Water. You heard that right, hydrogen infused water. On their website, they claim that their hydrogen water increases athletic performance, reduces inflammation from exercise, and contains the benefits of colloidal copper, gold, platinum, and zync. That sounds like a miracle drink, like water straight from the fountain of youth.

Paired with the fact that this company is listed on the Over-the-Counter market under the ticker $LTNC, home to little-regulated startups, sketchy manipulation, and horrible liquidity, I reserve every right to be cautious about this company. What makes them different? Well, does Manny Pacquiao himself promote your drink? Athletes from the NFL, MLB, and even the Olympics are among the many celebrities endorsing the beverage. Just because a well known person says that I should buy this hydrogen water, surely I should too right?

The NXT LVL drink was so intriguing and I decided to go ahead and buy myself a case. I looked forward to reclining on the couch on a Saturday afternoon while sipping my hydrogen water with no worries about finals whatsoever. I checked out their website to find limited options, the smallest being a 12-pack costing $36.00. Keep in mind I’m kind of broke so it was a punch in the gut to find out I’m paying three dollars a can for this stuff. Well, after all this research, I have no other choice. I put in my information and was prompted with the most disgusting thing I’ve ever seen.

$13.95 shipping.

They also have an option for FedEx First Overnight® which costs $197.82 just in case you’re interested.

Alright let’s forget about that. I still like the company and I want to own a piece of them. I decided to buy 1000 shares because why not? Each share cost $0.0293 which means I bought $29.30 worth of shares. That was until I found out TD Ameritrade has a $6.75 commission on OTC trades. I could’ve bought almost 2 Big Macs from McDonalds. I’m kind of upset, not even going to lie.

Only a few minutes later, the share price rose by 8% in a matter of seconds because Labor Smart’s CEO made his daily journal entry tweet which investors found to be very positive. To give a little bit of scale, an S&P 500 index fund typically returns an average of 10% a year. It immediately came crashing down and the following day, closed down 8%. You’ve got to love penny stocks.

As of Friday, Jun. 4, my investment had grown by a whopping 12% resulting in a gain of $5.64 in the span of only a week. Although this doesn’t seem like much, to give some scale, a $10,000 investment adjusted to the same timeframe would’ve yielded $1,200. That’s quite impressive…

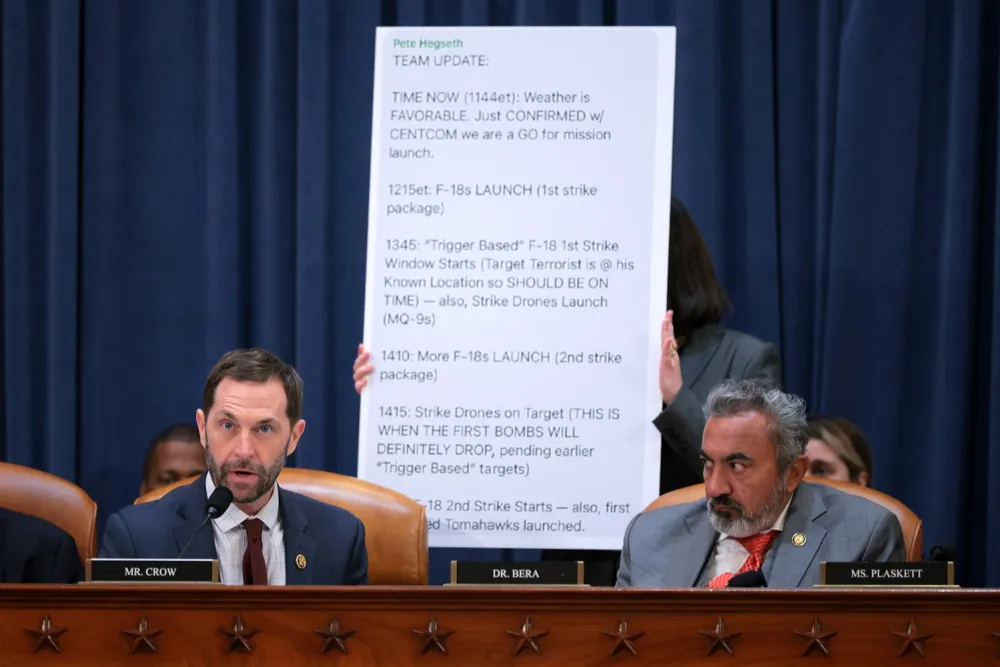

Until that fateful morning of Monday, Jun. 7. Takeover Industries broke the news that they were selling the “Labor Smart” trademark in order to focus on their beverage product ventures. Although they accepted an offer of $250,000 for the trademark, the share price tanked and closed down over 18% for the day.

At the end of it all, I’ve decided to end the challenge on Tuesday, Jun. 8 because I think I’ve gathered a good sense of what owning an OTC stock would feel like. At the end of it all, I took the L with a loss of $5.80. Do I think they will do well in the long term? Well, it’s important to note that according to CEO Joe Pavlik, they amassed over $150,000 in sales upon launch of their hydrogen water on Apr. 1 which is a massive feat for a company of their size. What’s more intriguing is that at a quick glance on Twitter, it seems like only their shareholders bought the drink out of support for their company. That begs the question over what happens when you take the shareholders out of the equation, how many of those people are true returning consumers? It’s extremely important to consider all outstanding factors when dealing with any of your investments. On second thought, some random guy from Arkansas just told me to “hodl” cause we’re “going to the moon”. Alright then.

Am I saying that you should go ahead and invest in Labor Smart or other OTC stocks? I’d caution you on that. Is it fun to discover and follow emerging companies? Absolutely! Takeover Industries’ NXT LVL drink is a very interesting concept that I’m rooting for to hit the shelves at our local supermarkets and gas station stores. Maybe one day, I’ll actually get to try it without spending $13.95 over shipping.